Choosing the right Magento payment gateway is essential not just for running a smooth Magento store, but also for boosting conversions and ensuring a seamless customer experience. For UK-based businesses, it’s especially important to offer trusted local payment options with competitive fees that integrate effortlessly with Magento. The right gateway can make checkout frictionless, build trust, and ultimately turn more visitors into loyal customers.

Below are the top local Magento payment gateways for UK stores, along with everything you should consider when selecting the best one.

Why Local Payment Gateways Matter

Using a payment gateway familiar to UK customers builds trust and can increase conversion rates. Local gateways often offer better rates for GBP transactions and understand regional compliance requirements like Strong Customer Authentication (SCA).

Top Magento Payment Gateways for UK Stores

1. Stripe

Stripe is a powerful, developer-friendly payment gateway with a strong presence in the UK and seamless Magento integration.

Key Features:

- Supports Apple Pay, Google Pay, Klarna

- Advanced subscription and billing tools

- Full SCA (Strong Customer Authentication) support

- Highly customizable checkout options

Magento Integration:

Multiple trusted Magento 2 extensions available with full support for advanced payment flows and custom experiences.

Best For:

UK merchants looking for flexibility, modern features, and international scalability.

2. PayPal

PayPal is one of the most recognised names in online payments, trusted by millions of consumers and merchants worldwide.

Key Features:

- Quick setup using Magento’s native integration

- Offers PayPal Pay Later and Pay in 3 options

- Boosts buyer confidence with brand recognition

- No need for a merchant account

Magento Integration:

Comes pre-integrated with Magento 2, allowing for simple activation and customization from the admin panel.

Best For:

Businesses wanting to offer quick, trusted, and flexible payment methods without added complexity.

3. Klarna

Klarna offers “Buy Now, Pay Later” services, making it popular among fashion, lifestyle, and high-ticket retailers.

Key Features:

- Pay in 3 and Pay Later options

- Full SCA compliance

- Enhances conversions by increasing buying power

- Trusted by leading e-commerce brands

Magento Integration:

Official Klarna extensions for Magento 2 are available, offering smooth integration and UI customisation.

Best For:

UK Magento stores looking to improve conversions with flexible finance options for customers.

4. Opayo (formerly Sage Pay)

Opayo is a UK-focused payment provider known for its reliability, excellent customer support, and compliance.

Key Features:

- Accepts credit/debit cards, PayPal, Apple Pay

- Advanced fraud screening tools

- Full PCI DSS compliance

- Domestic-focused transaction rates

Magento Integration:

Seamless Magento 2 modules are available from certified providers for secure and fast deployment.

Best For:

Small to medium UK businesses that value stability, security, and responsive support.

5. Worldpay

A well-known UK-based payment processor used by many enterprise-level e-commerce brands.

Key Features:

- Multi-currency and international payments

- Advanced fraud prevention tools

- Custom pricing models based on transaction volume

- High scalability for growing businesses

Magento Integration:

Magento plugins available for simple and secure integration into both Magento 1 and 2 platforms.

Best For:

Growing businesses and enterprises needing global reach and robust fraud protection.

Important Factors to Consider When Choosing a Gateway

Choosing a payment gateway isn’t only about finding one that’s popular. It’s about what suits your Magento store and your business goals.

Transaction Fees

Always compare:

- Setup fees

- Monthly fees

- Per-transaction fees

- Refund fees

Some gateways charge extra for certain card types, so check the fine print.

Customer Trust

UK customers often feel more secure when seeing familiar payment logos. Recognised names like Worldpay, PayPal, and Opayo can contribute to higher checkout completion rates.

Integration Quality

Look for official Magento 2 modules that are actively maintained and compatible with the latest Magento versions. Poorly supported extensions can cause issues during updates or checkout processes.

Support Availability

Choose a provider with UK-based customer service that is easy to reach. Email-only support might not be enough if you run into urgent issues during peak shopping times.

Security Features

Ensure the gateway offers:

- PCI DSS Level 1 compliance.

- Tokenization of payment details.

- Fraud prevention tools like 3D Secure 2.0.

Security standards directly impact your store’s reputation and customer trust.

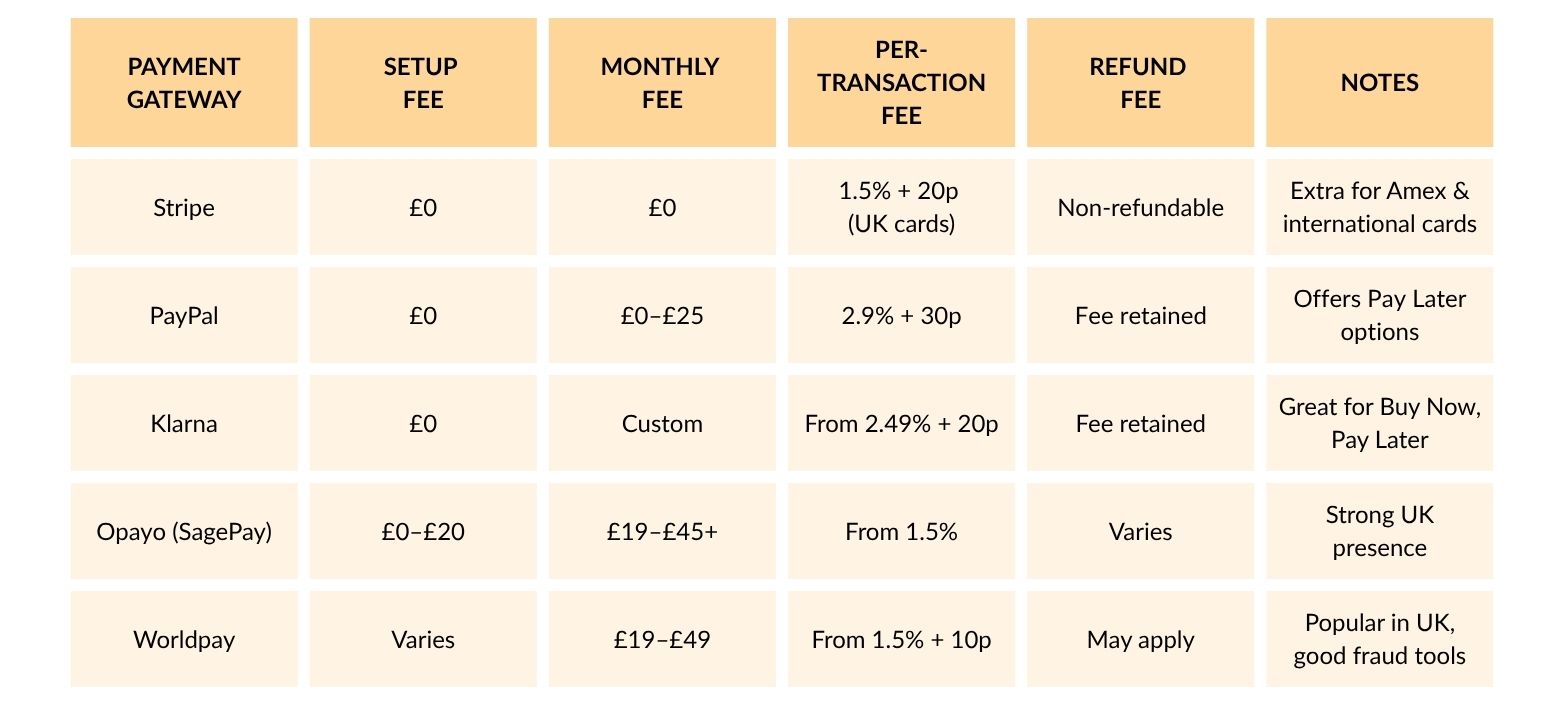

Payment Gateway Fee Comparison (UK Magento Integration)

Note: Fees can vary based on your sales volume, card types, and custom agreements. Always reach out to the provider for up-to-date pricing.

Magento Payment Tips for UK Stores

- Offer multiple payment options (card, PayPal, Apple Pay) to appeal to different preferences.

- Display security badges during checkout to reassure customers.

- Test your checkout process regularly to spot and fix any friction points.

- Keep your Magento and payment extensions up to date for security and performance improvements.

Conclusion

Selecting the right payment gateway for your Magento store can have a significant impact on your store’s performance, customer satisfaction, and operating costs. UK businesses should focus on trusted providers that offer strong local support, transparent pricing, and simple Magento integration. The gateways listed here are all proven options that can help streamline checkout and support your growth goals.